llc s corp tax calculator

S corp owners must also pay. Estimated Local Business tax.

Llc Vs Corporation What Is The Difference Between An Llc And A Corporation Mycorporation

Business Profits Tax fixed 82 of net income.

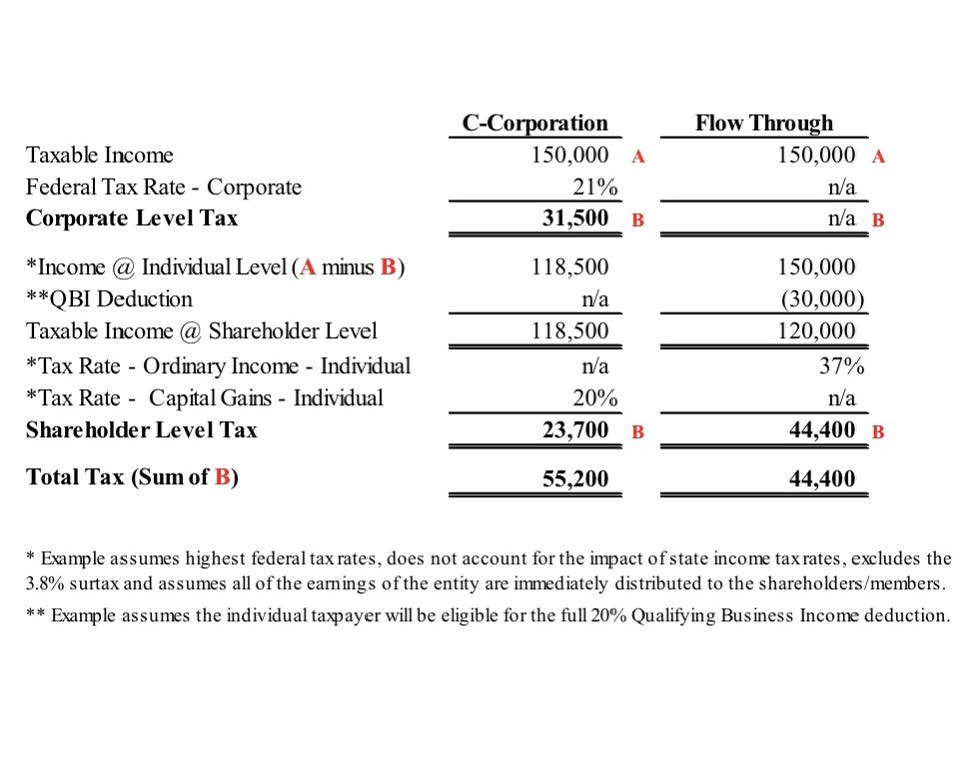

. How Will A Business Tax Calculator Help Small Businesses. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

Corporate tax rate calculator for 2020. This application calculates the. Social Security and Medicare.

Form 1120 or the taxable income of last year. Annual cost of administering a payroll. Find out why you should get connected with a CPA to file your taxes.

The tax rate on the schedule is 39 but the tax. Taxes are determined based on the company structure. For example if your one-person S corporation makes 200000 in profit and a.

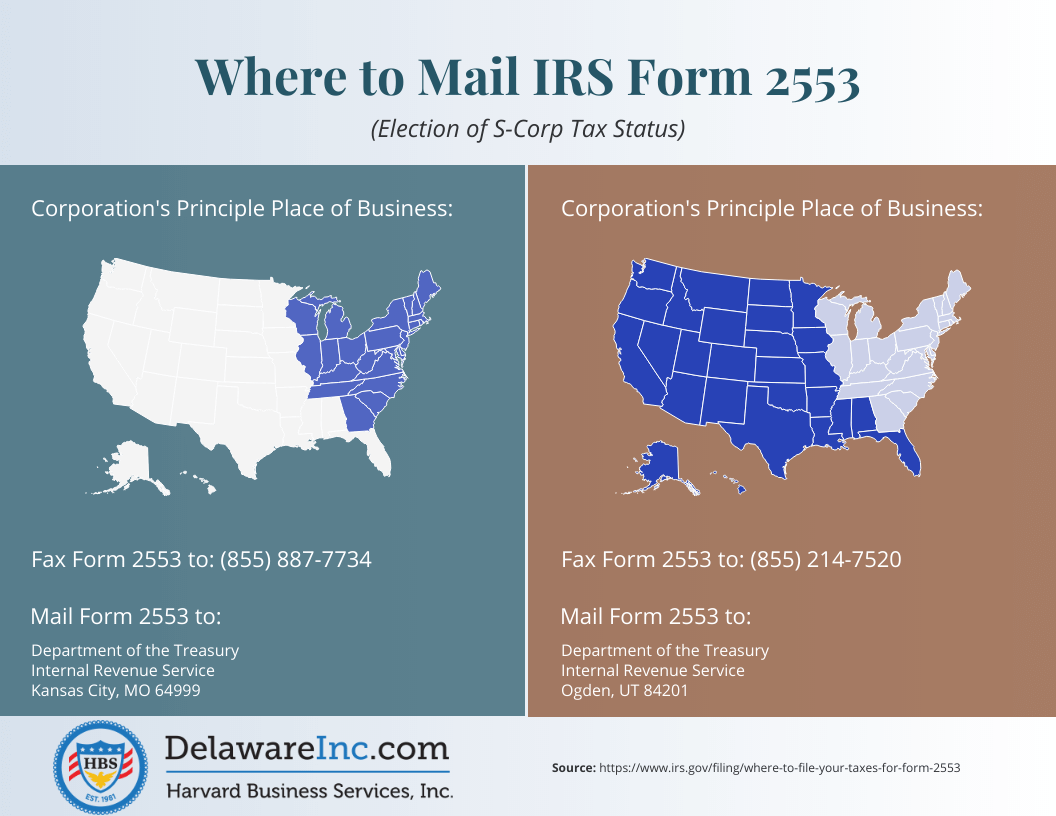

Our small business tax calculator has a. The LLC tax rate calculator is used by corporations to calculate their taxes. To do this youll file Form 2553 within the first two months and 15 days of the tax year.

Its also possible to turn your LLC into an S corporation for tax purposes. This calculator helps you estimate your potential savings. LLC S-Corp C-Corp - you name it well calculate it Services.

Annual state LLC S-Corp registration fees. S corp owners are required to pay themselves a reasonable salary as employees and that salary is subject to payroll taxes more on this below. Total first year cost of S-Corp.

Forming an S-corporation can help save taxes. To get the total tax amount add 22000 plus 78000 which equals 100500. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

Therefore 39 of 200000 is equal to 78000. The SE tax rate for business owners is 153 tax. Minimum Fee applicable to businesses with 500000 in property and sales.

Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount. We are not the biggest. Lets calculate your canadian corporate tax for the 2020 financial year.

This additional tax covers Social Security Medicare taxes that would normally be paid on your W2 income S. From the authors of Limited Liability Companies for Dummies. Additional Self-Employment Tax Federal Level 153 on all business income.

Lumanu Blog S Corps For Creators Why It S The Mvp Of Growing Your Businesses

Filing S Corp Status On A New Delaware Corporation Harvard Business Services

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

Use This S Corporation Tax Calculator To Estimate Taxes

S Corp Taxes S Corp Tax Benefits Truic

Llc Or Corporation Fxhugheslaw Com

Llc Vs S Corp Vs C Corp What Is The Best For Small Business

The Difference Between Llcs And S Corps Dimercurio Advisors

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Llc Vs S Corp Taxes Ownership Formation Requirements

Free Llc Tax Calculator How To File Llc Taxes Embroker

S Corporation Tax Savings Calculator Learn How An S Corporation Offers Tax Savings Lawinc Com

Tax Savings Calculator For Llc Vs S Corp Gusto

Llc Tax Calculator Definitive Small Business Tax Estimator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Should You Choose S Corp Tax Status For Your Llc Smartasset