how to file taxes for amazon flex

The general rule of thumb is to put away 30-35 of your Adjusted Gross Income income reduced by tax write-offs for taxes. Sign out of the Amazon Flex app.

How To File Amazon Flex 1099 Taxes The Easy Way

Driving for Amazon flex can be a good way to earn supplemental income.

. Click Download to download copies of the desired forms. Click ViewEdit and then click Find Forms. Amazon Flex quartly tax payments.

Most drivers are used to W2 withholding as full-time employees. Businesses such as partnerships S corporations or LLCs that are taxed as partnerships are required to file taxes by March 15 2022. Report Inappropriate Content.

If youre looking for a place to discuss DSP topics head over to ramazondspdrivers. Individuals C corporations sole proprietors single-member LLCs or LLCs taxed as corporations are required to file taxes by. It also has an IRS-compliant mileage log that estimates the trips reimbursement value.

Youll also pay income taxes according to your tax bracket. Sign in using the email and password associated with your account. Most people pay 153 in self-employment tax.

Once you calculate what that percentage is for the tax year divide that number by 4 -- and you have your quarterly estimated tax payments. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. Self-employment taxes include Social Security and Medicare taxes.

The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year. This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. If your payment is 600 or more you will receive a.

Ad We know how valuable your time is. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. Tap Forgot password and follow the instructions to receive assistance.

Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. Gig Economy Masters Course. Watching my deductions grow.

Unlike a W-2 employee Amazon doesnt pay half of your self-employment taxes. Use A Gas Rewards Card. The 153 self employed SE Tax is to pay both the employer part and employee.

Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. As an Uber driver you are required to prepay your taxes through estimated tax payments to the IRS four times per year. One of the simplest ways to save money on gas as an Amazon Flex driver is to use a rewards credit card when refuelling.

Amazon Flex drivers are independent contractors. Stride is a cool and free new option for mileage tracking. There are plenty of gas rewards cards that pay at least 1 to 2 cash back when you refuel.

Its gone from a chore to something I look forward to. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am. In fact there are numerous ways Flex drivers can save money on fuel costs.

However Uber Lyft and Amazon delivery drivers are independent contractors and therefore. With Everlance s auto-detect feature you dont need to worry about manually logging the miles you drive as a Flex driver because it how to pay tax for amazon flex and classifies the ride for whatever you need Work Personal Charity etc. You Will Need to Pay Estimated Taxes.

Its almost time to file your taxes. Understand that this has nothing to do with whether you take the standard deduction. This is your business income on which you owe taxes.

You pay 153 SE tax on 9235 of your Net Profit greater than 400. If youre an Amazon seller living in the US then youre probably aware that tax time is coming up. This app makes keeping track of my tax deductions a breeze.

Increase Your Earnings. It offers an automatic system that detects when youre driving so you can be sure to log every mile. In your example you made 10000 on your 1099 and drove 10000 miles.

How Much To Put Away For Quarterly Taxes. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after becoming aware of the FTCs investigation in 2019. This form will have you adjust your 1099 income for the number of miles driven.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. Created Jul 5 2016. Knowing your tax write offs can be a good way to keep that income in your pocket.

Get started now to reserve blocks in advance or pick them daily based on your schedule. If you get a check please cash it before January 7 2022. 5 Uber Lyft Amazon Drivers.

This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone. With Amazon Flex you work only when you want to.

Select Sign in with Amazon. 12 tax write offs for Amazon Flex drivers. That means you have to pay self-employment tax.

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Amazon Flex Filing Your Taxes Youtube

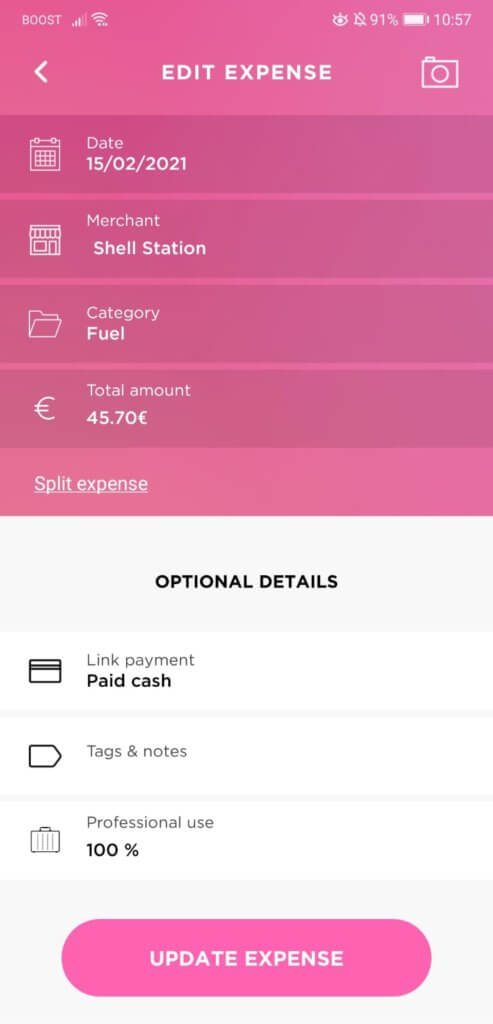

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tax Deductions Tracking App Mileage

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Do Taxes For Amazon Flex Youtube

How To File Amazon Flex 1099 Taxes The Easy Way

Amazon Flex End Of The Tax Year Youtube

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Does Amazon Flex Take Out Taxes Find Out Answerbarn

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Amazon Flex 1099 Taxes The Easy Way

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable